Grinnell Mutual identifies top causes of fire loss in 2022

Since 2020, people have been at home more than ever before, which means they’ve consumed more energy than ever before. In 2022, Americans used 1.42 trillion kilowatt hours of electricity in the United States, according to the U.S. Energy Information Administration.

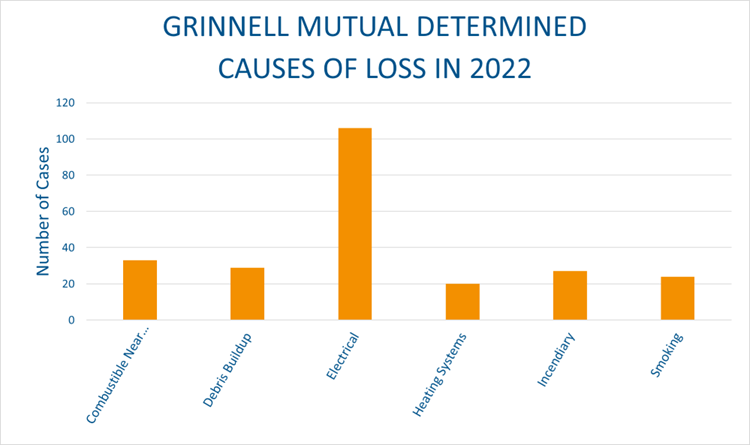

As people use electricity to power their home offices, appliances, and devices, they also increase their risk of an electrical fire. In fact, electrical fires were the leading cause of fire loss for Grinnell Mutual insureds in 2022, according to Grinnell Mutual’s Special Investigations department. Electrical issues caused 106 of the 239 determined fires they investigated last year.

Grinnell Mutual’s Special Investigations Department also determined that other fires were caused by combustibles near a heat source (33), debris buildup (29), incendiaries (27), smoking (24), and heating systems (20).

A majority of fire cases they investigated had a determined cause of loss.

Preventing electrical fires

To prevent electrical fires, the U.S. Consumer Product Safety Commission offers these recommendations:

- Use the recommended wattage for bulbs in light fixtures.

- Place your portable heater on a stable surface and ensure it is out of the flow of traffic.

- Do not use electrical appliances that have odd smells, sparks, or smoke when you operate them.

- Replace cords that are damaged, cracked, or frayed.

- Replace outlets and switches that are warm or not working properly.

Water can also cause electrical fires when combined with a live circuit. And since water is a great conductor of electricity, it can spread the fire. Always keep electrical equipment away from water and dampness and cover any exposed wires.

In addition to starting fires, electrical currents can shock you. Always use caution when working near electricity and make sure your grounding system is appropriate. If you work on electrical equipment, consider wearing rubber gloves and boots. And never operate electrical equipment while you are standing in water.

How to put out an electrical fire

If you discover an electrical fire in your home or business:

- Call 911.

- If it is safe to do so, use a Class C or multi-class (ABC) fire extinguisher. Class C is the type of fire extinguisher designed for electrical fires. Never use water to put out an electrical fire.

- If it is safe to do so, shut off the power source.

If a loss seems suspicious

If you suspect fraud or arson, report it to local law enforcement. Next, call your insurance agent or company or the state insurance department. You can also call Grinnell Mutual's Fraud and Compliance hotline at 855-467-2372.

Our Fraud and Arson Award program provides up to $10,000 for providing timely and credible information about a fraudulent or criminal loss to people or property insured by Grinnell Mutual or one of our mutual members.

Report fraud or arson