Grinnell Re | Broker-assumed reinsurance

Grinnell Re is the reinsurance division of Grinnell Mutual. We support quality treaty reinsurance programs and provide strong financial security by focusing on long-term, trusted personal relationships.

As a mutual company, we’re not just a transactional reinsurer. We’re a true strategic partner that can offer creative reinsurance solutions. Together, we share a common purpose and a common interest: moving companies forward.

By the numbers (2024 year-end)

- $1.6 billion in total assets

- $803 million in surplus

- Providing quality reinsurance to mutual companies since 1909

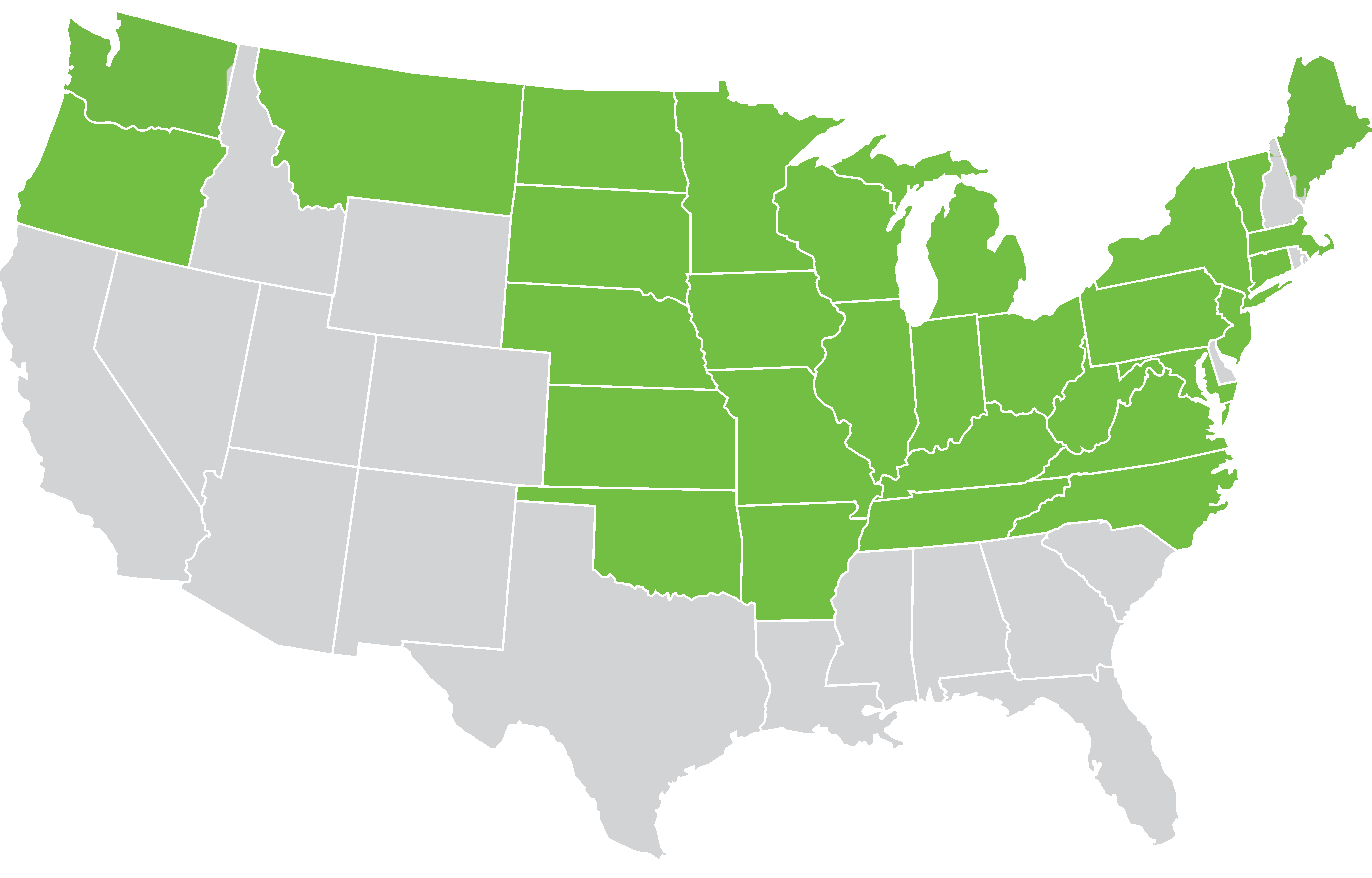

Grinnell Mutual is an accredited reinsurer in 30 states.

Underwriting coverages

We have a long-standing commitment to reinsuring mutual companies and an expanded focus on regional, super-regional, and specialty underwriters.

- Property

- Casualty

- Multiple Line Excess

- Property Catastrophe

Meet the Broker Market team

Ryan Walsh

Assistant Vice President, Reinsurance Underwriting

Eric Schulz | JD, MBA, AIC

Assistant Vice President, Claims

Bob Clark | ARM, ARe

Director, Reinsurance Underwriting

Stephen Palkert | ACAS

Director, Reinsurance Actuary

Darryl Sorenson | ACAS, MAAA

Director, Reinsurance Actuary